Gifting Letter Template

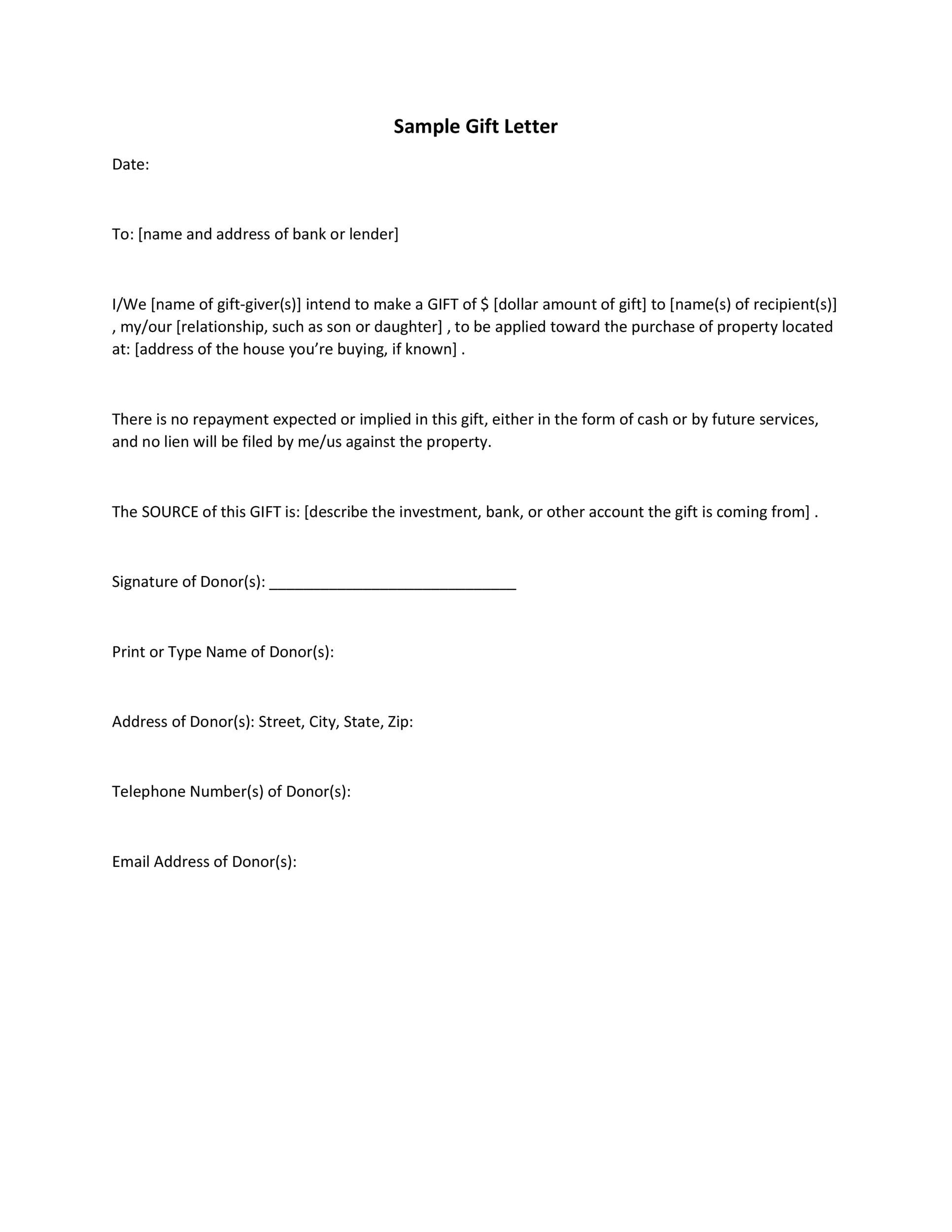

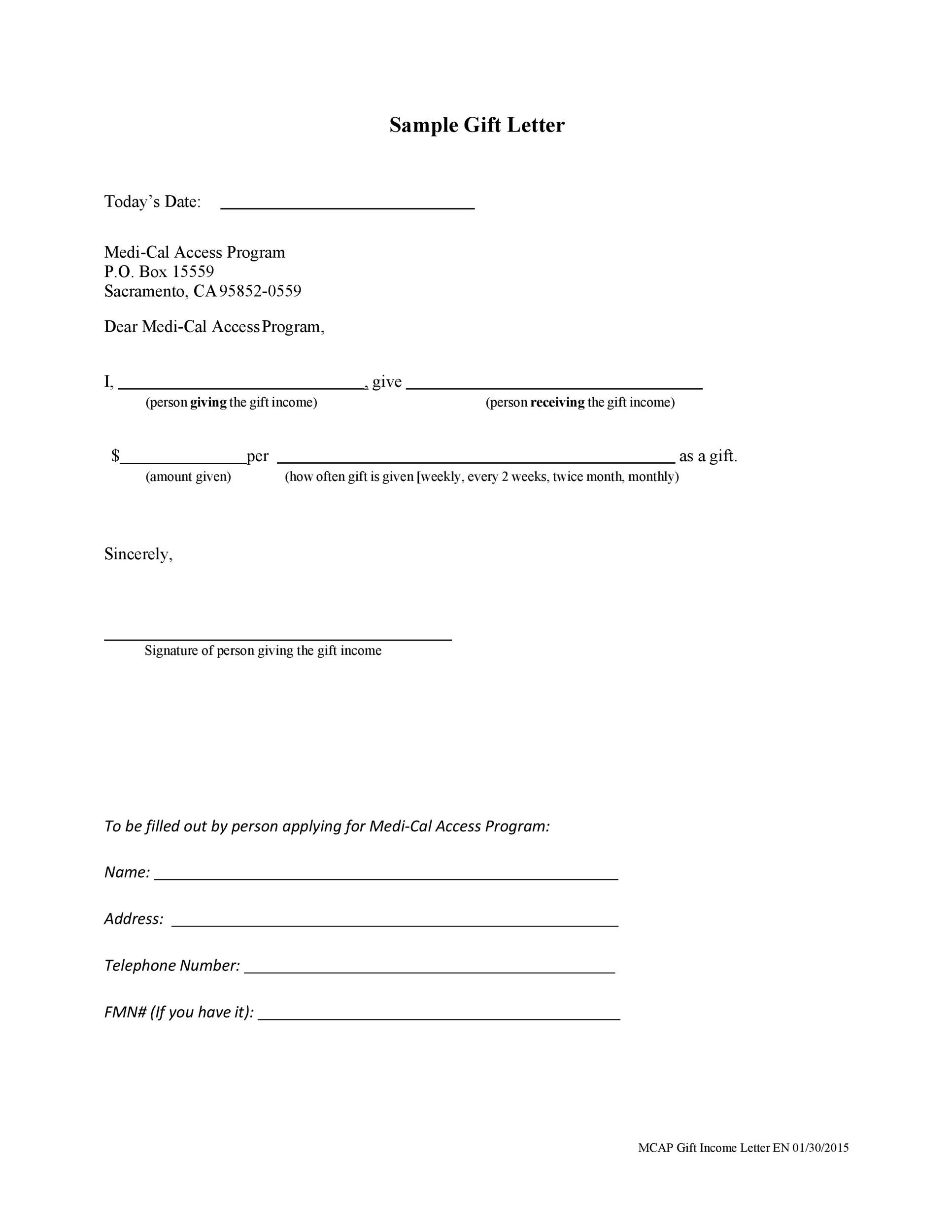

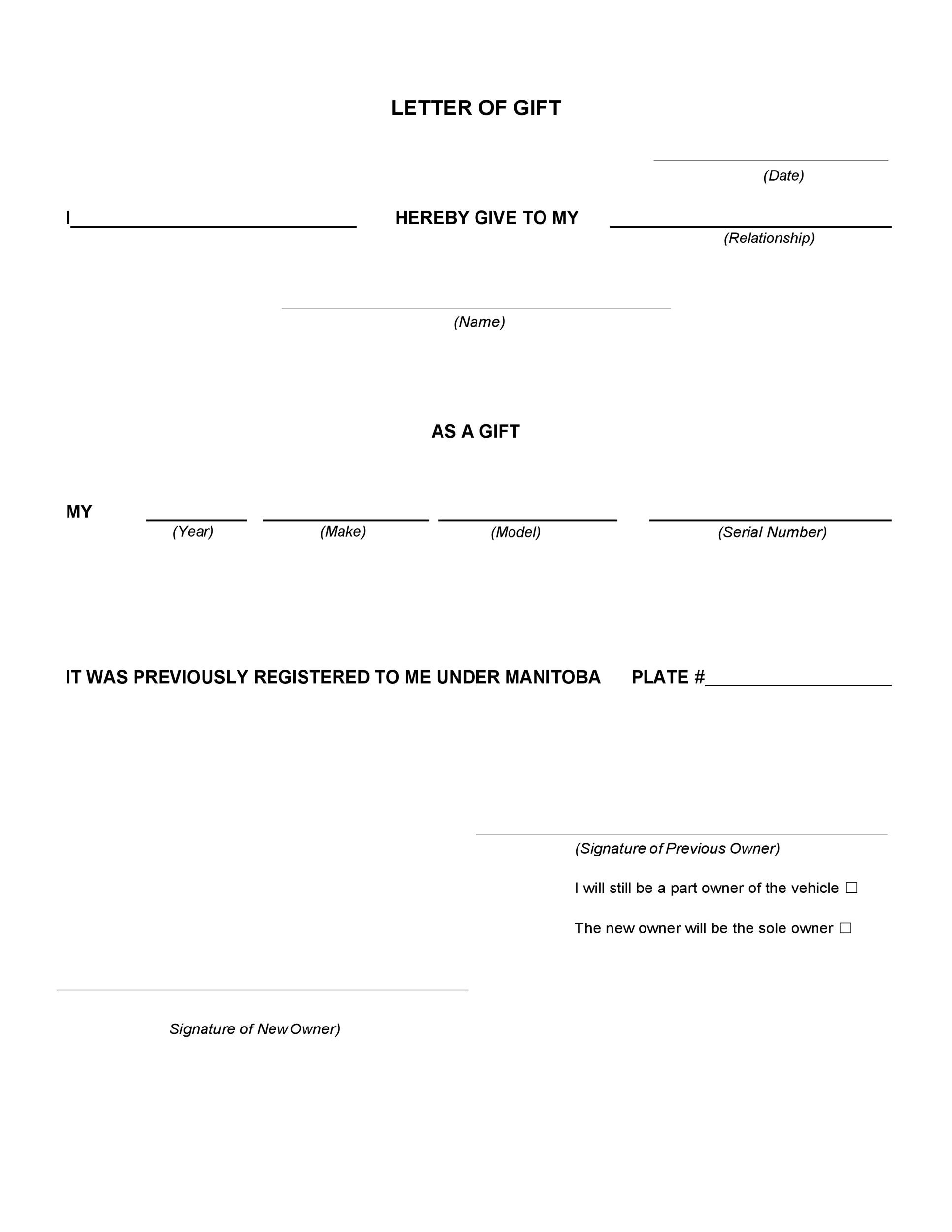

Gifting Letter Template - Cash gifts and income are subject to irs reporting rules. Understand the key guidelines and considerations for gifting money to family, including tax implications and documentation requirements. Giving financial gifts to your children, family members, and loved ones is a great way to help set them up for their future. For smaller sums, cash is an easy way to gift money. Does it make sense to give up this money? Gifts of up to $19,000 in cash are exempt from reporting in 2025. Because of annual and lifetime limits, few people end up owing it. Find common questions and answers about gift taxes, including what is considered a gift, which gifts are taxable and which are not and who pays the gift tax. Here are five ways you can gift money to someone, including checks, cash, payment apps and more. Many, or all, of the products. Does it make sense to give up this money? Knowing the annual gift tax exclusion can save you money and spare you from filing gift tax returns. Because gifting is irrevocable, it’s important to ask yourself: Find common questions and answers about gift taxes, including what is considered a gift, which gifts are taxable and which are not and who pays the gift tax. This article will explore how gifting works, the current landscape of gift tax rules under the tax cuts and jobs act (tcja), and the impending changes after the tcja’s. Many, or all, of the products. Understand the key guidelines and considerations for gifting money to family, including tax implications and documentation requirements. For smaller sums, cash is an easy way to gift money. Here are five ways you can gift money to someone, including checks, cash, payment apps and more. Gifts of up to $19,000 in cash are exempt from reporting in 2025. Cash gifts and income are subject to irs reporting rules. Does it make sense to give up this money? Find common questions and answers about gift taxes, including what is considered a gift, which gifts are taxable and which are not and who pays the gift tax. Knowing the annual gift tax exclusion can save you money and spare you. Cash gifts and income are subject to irs reporting rules. Because of annual and lifetime limits, few people end up owing it. Giving financial gifts to your children, family members, and loved ones is a great way to help set them up for their future. Because gifting is irrevocable, it’s important to ask yourself: Those who have household employees must. Here are five ways you can gift money to someone, including checks, cash, payment apps and more. Because gifting is irrevocable, it’s important to ask yourself: Cash gifts and income are subject to irs reporting rules. Giving financial gifts to your children, family members, and loved ones is a great way to help set them up for their future. Because. Giving financial gifts to your children, family members, and loved ones is a great way to help set them up for their future. Because of annual and lifetime limits, few people end up owing it. Cash gifts and income are subject to irs reporting rules. This article will explore how gifting works, the current landscape of gift tax rules under. Does it make sense to give up this money? Giving financial gifts to your children, family members, and loved ones is a great way to help set them up for their future. Here’s what you need to know about the federal gift tax and how much. Those who have household employees must report. How does gifting fit into my overall. Giving financial gifts to your children, family members, and loved ones is a great way to help set them up for their future. How does gifting fit into my overall financial picture and financial health? Gift tax is a federal tax on the transfer of money or property to another person. This article will explore how gifting works, the current. This article will explore how gifting works, the current landscape of gift tax rules under the tax cuts and jobs act (tcja), and the impending changes after the tcja’s. How does gifting fit into my overall financial picture and financial health? Because of annual and lifetime limits, few people end up owing it. Those who have household employees must report.. Here’s what you need to know about the federal gift tax and how much. For smaller sums, cash is an easy way to gift money. Knowing the annual gift tax exclusion can save you money and spare you from filing gift tax returns. Giving financial gifts to your children, family members, and loved ones is a great way to help. Cash gifts and income are subject to irs reporting rules. Does it make sense to give up this money? Here are five ways you can gift money to someone, including checks, cash, payment apps and more. Gift tax is a federal tax on the transfer of money or property to another person. How does gifting fit into my overall financial. Those who have household employees must report. Here are five ways you can gift money to someone, including checks, cash, payment apps and more. For smaller sums, cash is an easy way to gift money. Giving financial gifts to your children, family members, and loved ones is a great way to help set them up for their future. Gifts of. Understand the key guidelines and considerations for gifting money to family, including tax implications and documentation requirements. Find common questions and answers about gift taxes, including what is considered a gift, which gifts are taxable and which are not and who pays the gift tax. Here’s what you need to know about the federal gift tax and how much. Knowing the annual gift tax exclusion can save you money and spare you from filing gift tax returns. Cash gifts and income are subject to irs reporting rules. Whether you’re writing a check, sharing stock, or gifting property, the. Giving financial gifts to your children, family members, and loved ones is a great way to help set them up for their future. How does gifting fit into my overall financial picture and financial health? Because gifting is irrevocable, it’s important to ask yourself: For smaller sums, cash is an easy way to gift money. Gifts of up to $19,000 in cash are exempt from reporting in 2025. Because of annual and lifetime limits, few people end up owing it. Here are five ways you can gift money to someone, including checks, cash, payment apps and more. Many, or all, of the products.Printable Family Member Gift Letter Template

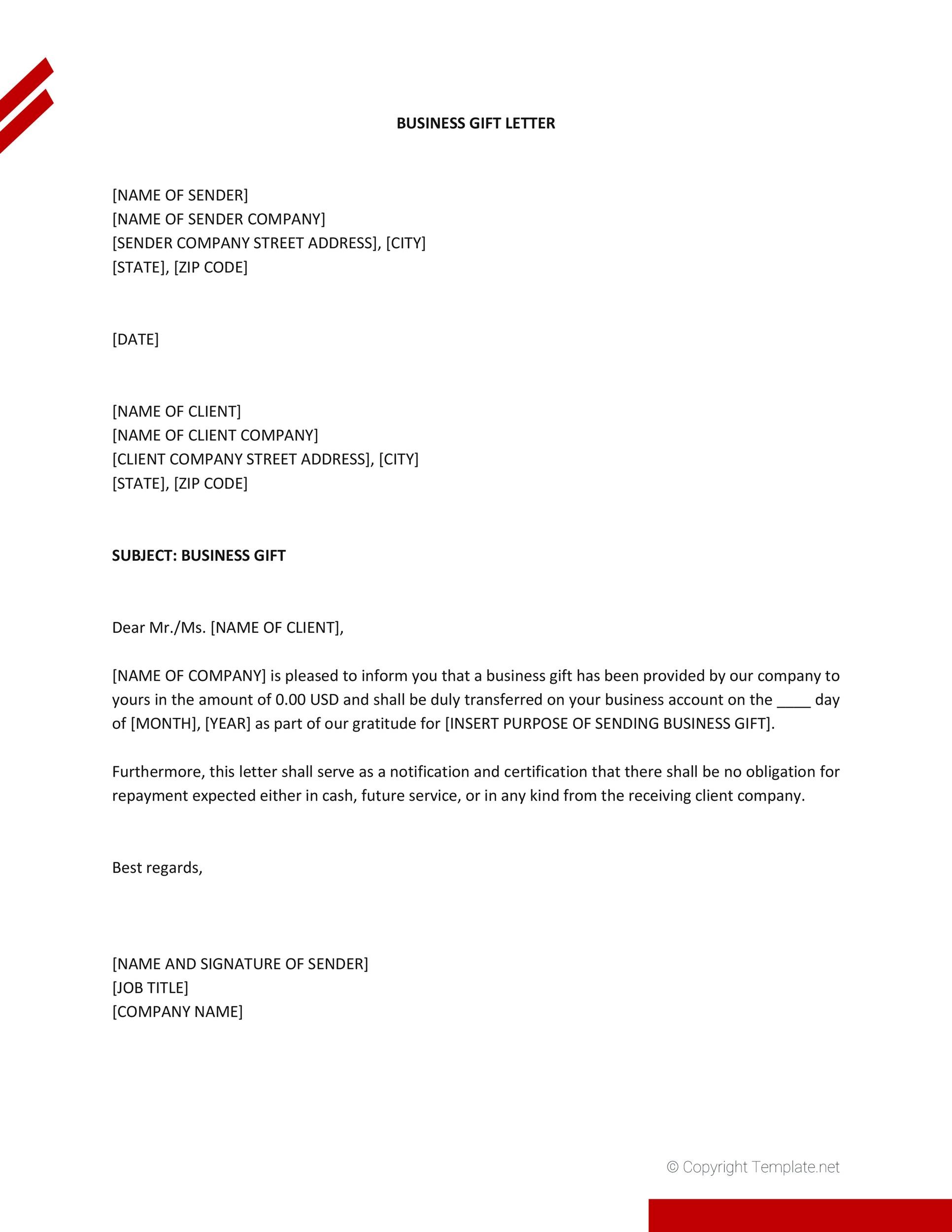

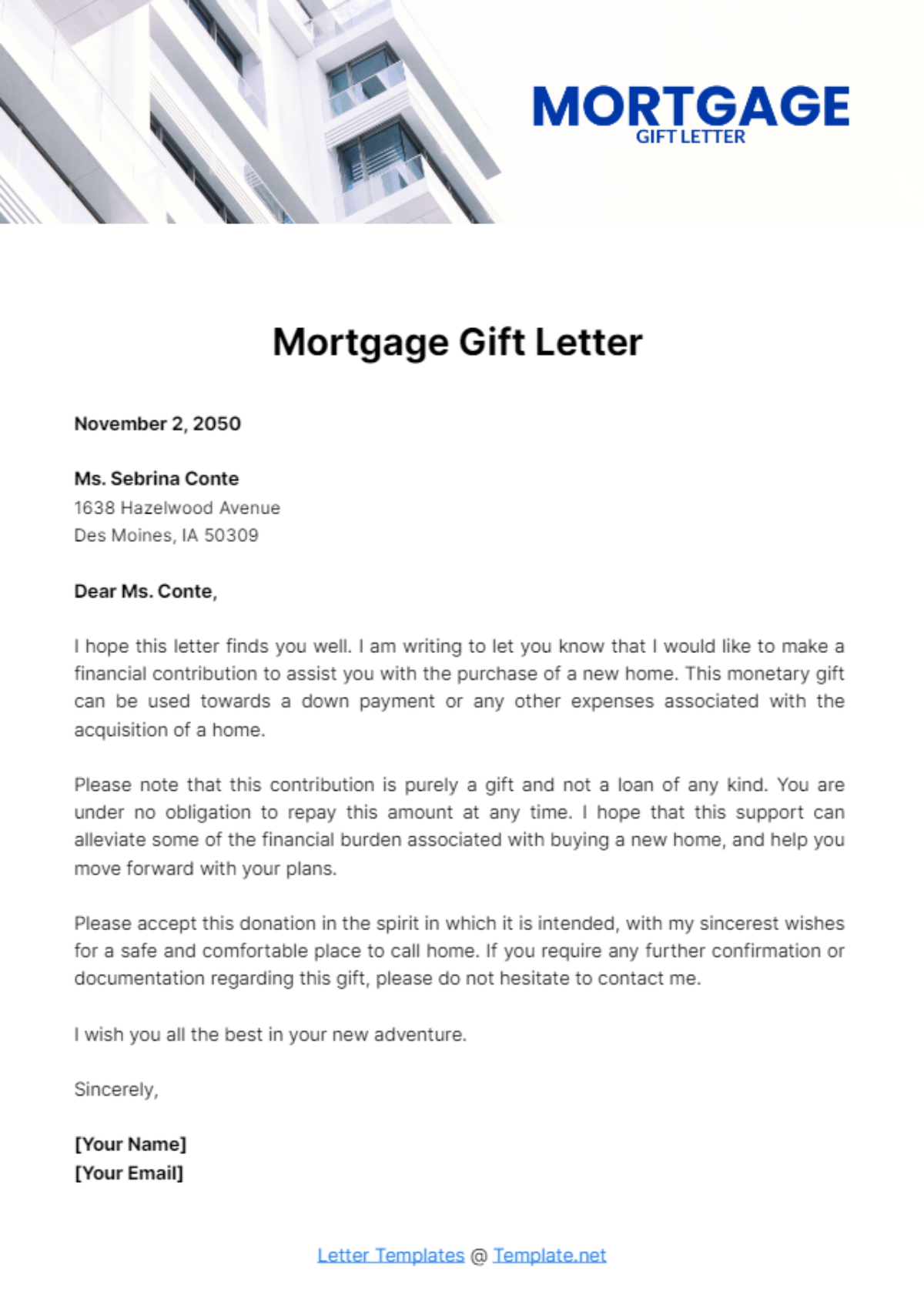

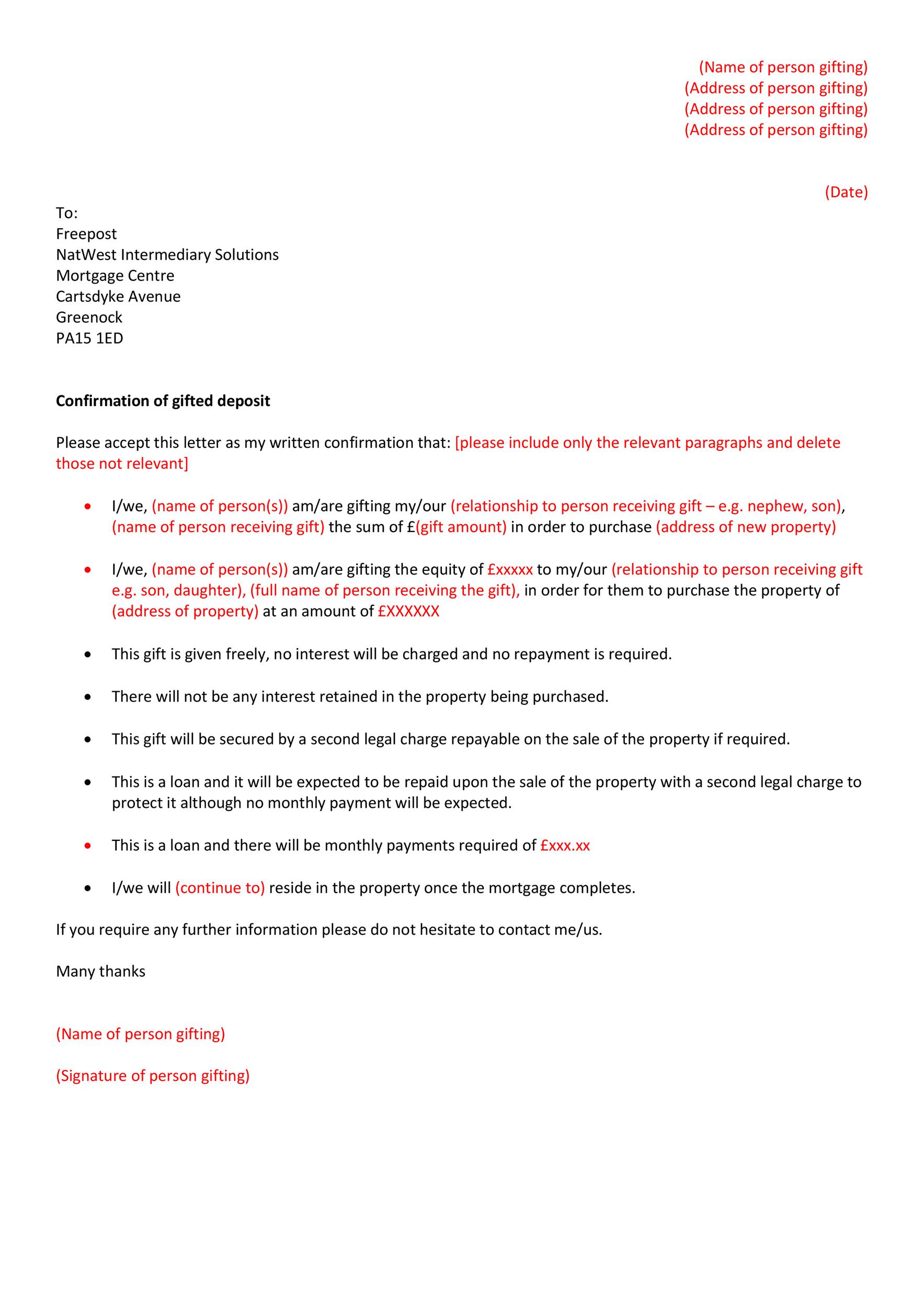

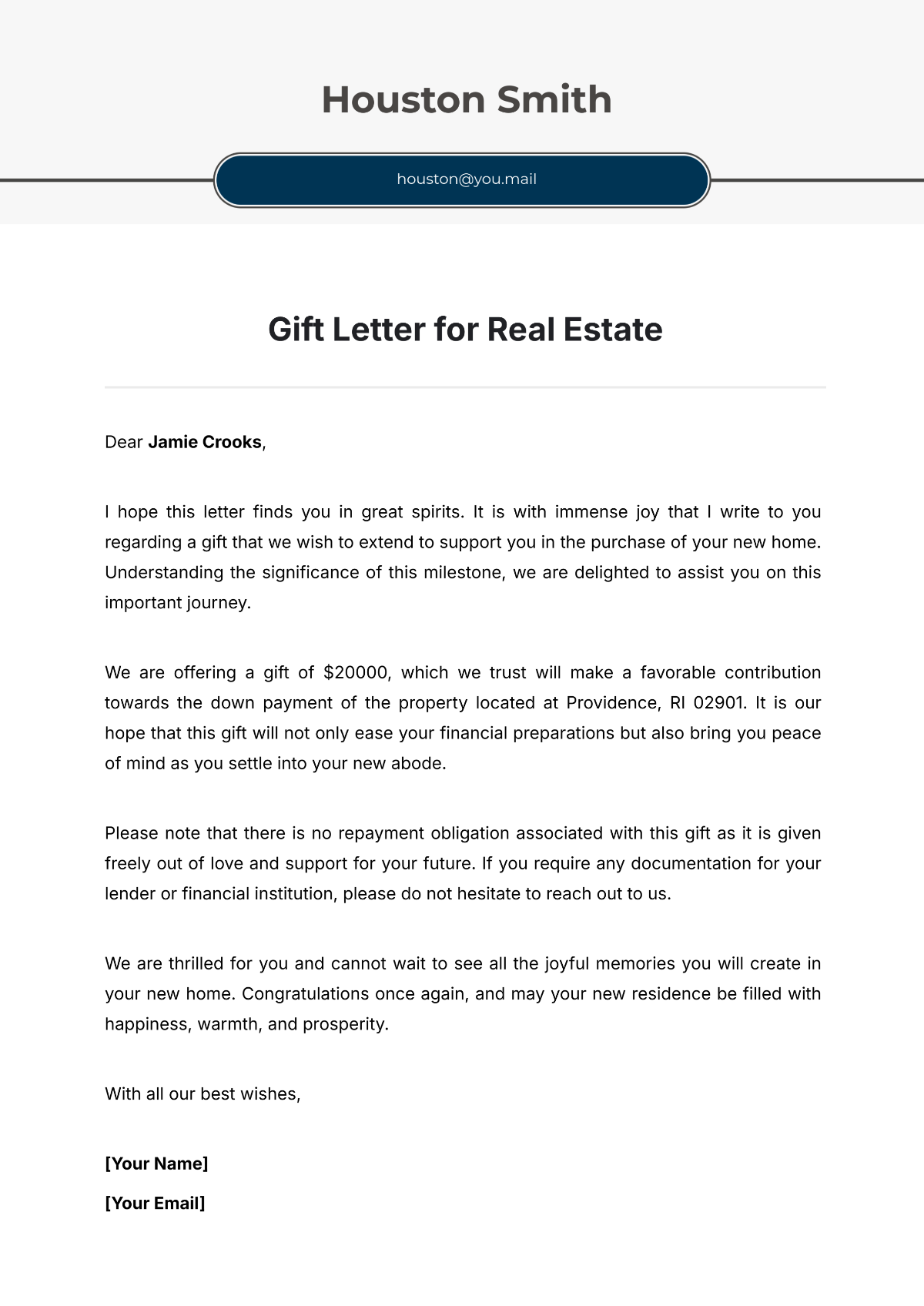

Mortgage Gift Letter Template Edit Online & Download Example

Family Member Gift Letter Template

Template For Gift Letter at John Heidt blog

Free Printable Gift Letter Templates / Car, Boat, Mortgage [PDF, Word]

Free Gift Letter for Car Template to Edit Online

Free Printable Gift Letter Templates / Car, Boat, Mortgage [PDF, Word]

Gifting Letter Template

Printable Mortgage Gift Letter Template Printable Templates Online By

Gifting Letter Template

Gift Tax Is A Federal Tax On The Transfer Of Money Or Property To Another Person.

Does It Make Sense To Give Up This Money?

This Article Will Explore How Gifting Works, The Current Landscape Of Gift Tax Rules Under The Tax Cuts And Jobs Act (Tcja), And The Impending Changes After The Tcja’s.

Those Who Have Household Employees Must Report.

Related Post:

![Free Printable Gift Letter Templates / Car, Boat, Mortgage [PDF, Word]](https://www.typecalendar.com/wp-content/uploads/2023/05/Gift-Letter-For-Mortgage-1.jpg)

![Free Printable Gift Letter Templates / Car, Boat, Mortgage [PDF, Word]](https://www.typecalendar.com/wp-content/uploads/2023/05/downpayment-gift-letter-scaled.jpg)